Why is CPA better than Revshare? Using real-world examples (Keitaro, William Hill, Cityads, etc.), I explain why “lifetime” percentages are rarely eternal, and tell you my path from a revshara to a CPA.

- A brief overview: how revshare and CPA work

- Keitaro: when lifetime deductions end abruptly

- William Hill and others: history repeats itself

- My experience: from disappointment in revshare to betting on CPA

- CPA stability benefits in the long run

A brief overview: how revshara and CPA work

Revshara (revengesharing) in affiliate marketing is a reward model in which the webmaster receives a percentage of the company’s revenue for each attracted customer. Moreover, payments can be made throughout the entire “life cycle” of the client, i.e., as long as the client brings money to the company. It sounds tempting: once you bring in a client, you can earn passive income for the rest of their life.

On the other hand, there is the CPA (cost per action) model, where the affiliate receives a fixed fee for a specific action (registration, sale, deposit, etc.) and no longer claims to earn from that user in the future.

Once upon a time, I also considered revshara to be the optimal traffic monetization strategy. For example, back in 2011, in my post “Profit Sharing — a new stage in the development of online advertising,” I discussed the prospects for this approach.

However, real-world experience and market observations have convinced me otherwise. Below I will share a few practical stories that clearly show why “lifetime” interest rates are rarely lifetime, and why today I am betting on the CPA model.

Keitaro: When Lifetime Commissions Suddenly Stop

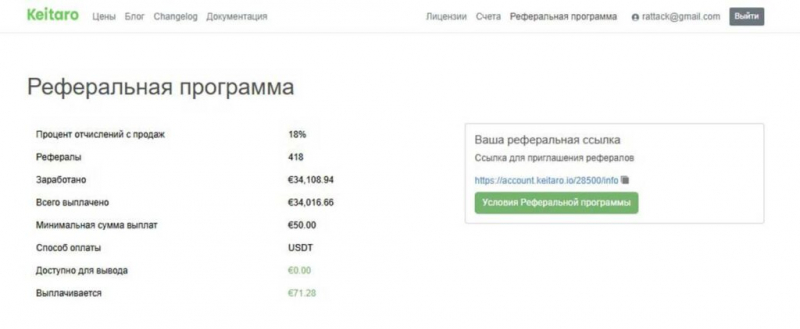

One of the most high-profile events of this week was the unexpected termination of the referral program of the popular tracker Keitaro (similar to Binom). On August 20, 2025, Keitaro completely stopped charging interest on its referral program, leaving its partners with nothing.

For many, it was a shock: people had been referring customers for years and receiving rewards (for example, the Yellow Web could earn up to ~$2,000 per month through lifetime earnings from ~418 referrals). Suddenly, there were no more payments.

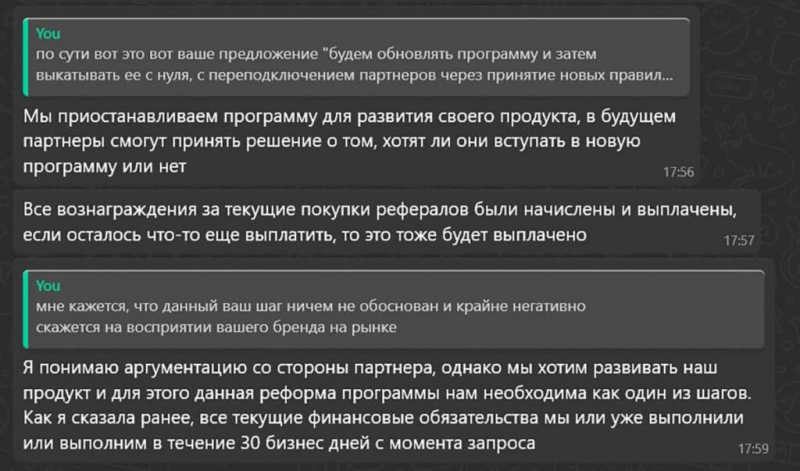

Officially, the Keitaro team announced a “referral program restart”, citing some internal reasons (compliance, new company policy, etc.). But in fact, it looked like a blatant deception: old partners were simply disconnected from payments, the base of the customers attracted by them was reset, and it was made clear that nothing would be paid further.

The situation was made more cynical by the fact that Keitaro invited the same webmasters to participate in their new affiliate program after the relaunch, effectively offering them a “fresh start” and forgetting about the lost revenue.

This action did not go unnoticed in the community. The same author of the Yellow Web Telegram channel (who suffered from the disconnection of referral fees) described Keitaro’s actions as a “scam,” noting that the tracker’s management used vague language to cover up their actions and essentially abandoned their partners.

By the way, they later uploaded bots to the channel.

Yellow Web accurately pointed out that in their business correspondence, Keitaro representatives claimed that “all payments were made in full and in accordance with the rules” and that they had the right to close the program under the terms of the agreement. But “in full” for a lifetime deal means “as long as the customer pays.” How much can we talk about in full if the payments were simply taken and stopped ahead of schedule?

As a result, the message to the partners was very clear:

“New customers If we need them, bring them, and we’ll pay you for a while. And we think we’ve already paid enough for the old ones – go have a nice day.”

Of course, there can be no question of any trust after such a thing.

Why is this case important? It once again shows the main vulnerability of a revshare: your “lifetime” share depends on the company’s goodwill. If the management decides that it’s time to “cut costs,” the passive income stream will dry up in a single day.

Formally, the rules often state that the program can be closed unilaterally (as was the case with Keitaro). However, this is little comfort for partners. You have been promoting the product for years, expecting long-term payments, only to be told:

“Sorry, the rules have changed. There will be no more money.”

William Hill and Others: A Repeat of History

If you think that the Keitaro case is an isolated incident, then, alas, this is far from the truth. Such scenarios are played out in the market on a regular basis, and even with major brands.

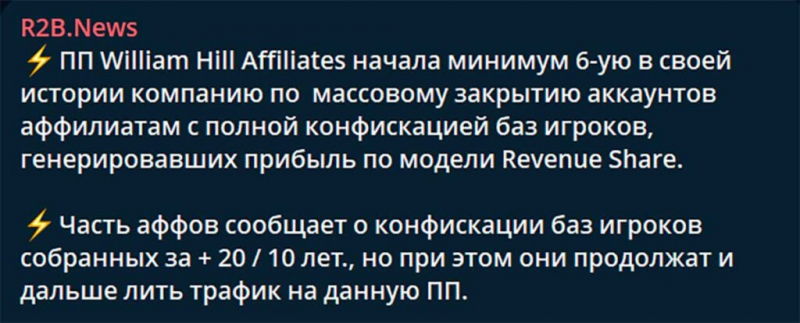

A classic example is the affiliate program of the betting company William Hill. In the gambling industry, this company is notorious for massively closing the accounts of its affiliates working on Revshare every few years.

For example, in March 2024, the sixth wave of such shutdowns took place: the accounts of webmasters were put under the knife, along with all the player databases that they had been accumulating for 5-10 years! Naturally, the payments to these players were immediately stopped, and all the years of work on building a Revshare “pension” were in vain.

It’s interesting that William Hill doesn’t even try to hide its motives. According to insiders, they carry out such “cleansings” when the company needs to improve its finances, such as covering losses from a bad quarter.

In simpler terms, they save money by reducing affiliate payments. And they can always cover themselves with a new management:

“The decision was made by the previous team, so let’s forget the past and start over.”

Sounds familiar, doesn’t it?Very similar things were written to partners and in Keitaro.

Even more striking is how the webmasters themselves react. It would seem that after such a thing, no one will work with WH again. However, in practice, many … come back!

As the Gray Hat channel notes, for many affiliates, such risks have become “just part of the business.” As long as their sites and traffic allow them to earn here and now, they are ready to pour traffic, even knowing that in a couple of years, the account may be blocked again.

In fact, it’s a game of chance: “Will it pass or not?” Some people are attracted by the potentially higher revenues of the revshare (after all, a player can bring profit to a bookmaker’s office or a casino for many years). Others hope that their account won’t be affected. And some people simply naively believe in the managers’ promises to “forget the past and look to the future.”

But the facts remain the same: there will be no lifetime interest if the company decides otherwise. Today it’s William Hill or Keitaro, tomorrow it’s any other service. The reasons may vary (change of ownership, desire to increase profits, legal nuances), but the outcome is the same: the webmaster suddenly stops receiving money from the leads, even if they continue to generate revenue for the company. In the end, only the company itself benefits by removing its obligations to make payments.

My experience: from disappointment in revsshar to betting on CPA

My personal path in affiliate marketing has also gone through a reassessment of the brand. If in the early 2010s the idea of “bringing a client once, you earn for years” seemed attractive, then reality quickly sobered up. In addition to high-profile stories like the above, there were also small lessons (Cityads, Admitad, and a number of other partners).

Back in 2020, I ran into problems on the side of the CityAds partner network, which I was working with at the time. First, I found discrepancies in the statistics and delays in the support responses. Second, I noticed that some webmasters (sub-partners) had disappeared from my referral structure.

It took some time to figure out that:

“The referrals have dropped off because they are not reaching the minimum threshold, and the referral system will be redesigned.”

Sounds familiar, right? Again, “refining the referral program.” As a result, I realized that this could not continue, and I decided to end my partnership with this network.

By the beginning of the fall of 2020, I had fully transferred my traffic to other programs, primarily to the market leader, Admitad, where I worked on a CPA model. In the report “Fall 2020: CityAds’ Disappointment,” I described this transition in detail and the reasons behind it.

Since then, my approach has changed dramatically. CPA schemes have become the basis of my earnings, and I’ve never regretted it. Yes, with CPA, you get a one-time payout, and theoretically, you could earn more on a referral if the user “lived” for a long time. However, as we can see, no one guarantees that you’ll be able to earn this percentage as long as the customer is active. Additionally, it’s psychologically reassuring to know that the deal is closed: you’ve brought in a lead or a customer, and you’ve immediately received your money.

Here are the main reasons why I choose CPA over RevShare today:

- Guaranteed payment here and now. CPA rewards are paid immediately after the target action is completed. You are not dependent on the user’s future behavior or the advertiser’s willingness to pay you for years. If you complete the task, you will receive the payment.

- No “knife in the back.” In CPA, there is no situation where, after a year or a year and a half, you suddenly lose payment for already acquired customers. The company can only change the conditions for future acquisitions, but not for already paid actions. This ensures predictability and stability.

- Transparency and ease of calculation. It is easier to plan your budget and ROI, as you know how much you will receive for a conversion and can immediately reinvest this money. In contrast, revenue sharing is spread out over time and depends on various factors beyond your control.

- Less dependence on the partner’s honesty. Unfortunately, cases of fraud and one-sided rewriting of the rules are not uncommon (Keitaro and WH are just the tip of the iceberg). A CPA network or advertiser can also be dishonest, but they have much less room for manipulation: either they paid a fixed amount for a lead or they didn’t. There’s no long history to break.

- Reputational risks. It’s important for me not to associate with companies that cheat their partners. After the Keitaro incident, some influencers have publicly stated that they will no longer recommend them. I don’t want to expose myself and my audience to such disappointments. It’s more comfortable for me to work with models that don’t initially promise “mountains of gold” forever.

Of course, Revshare programs can still be attractive in certain niches. There are examples of webmasters earning significant amounts over the years. But the key question is, at what cost and with what risks?

Are you willing to invest your time and money knowing that the tap could be turned off at any moment? For me, the game is not worth the candle. I would rather have less potential, but be confident in my payments and be able to plan the development of my projects.

CPA stability wins in the long run

My experience over the past few years has clearly shown me that stability wins in the long run. Revshare offers the promise of passive income, but it often leads to disappointment. Companies can change their terms, close their programs, or even disappear (as was the case with Above all Offers and Peerfly), and then all your “lifetime” contributions turn into an empty zero.

The CPA model is free from this trap – it is honest in its simplicity. You bring a client – you get your reward and move on.

For my blog and projects, the choice is clear. I try to build my monetization so that I don’t depend on someone’s whims or financial problems. Yes, I still keep an eye on the industry and understand where a revshare can pay off. But every time I’m tempted to take a revshare, I remember cases like Cityads or William Hill and calmly tell myself, “Thanks, but I’ll pass. I’d rather have a CPL/CPA without the risk.” After all, our earnings should bring us joy and motivation, rather than keeping us in constant fear of losing everything at once.

What experience with Revshare or CPA have you had? Share in the comments – especially if you had cases of switching from Revshare to fixed payments. The industry does not stand still, and our exchange of experience will help others make the right choice. After all, the goal is the same for everyone – to earn money, without unnecessary nerves.

Binom tracker recommendation of the week: