After several years of active (and not very active) trading on various crypto exchanges, I chose OKX. This choice was not made by chance – I carefully compared OKX with other top platforms, such as Binance, Bybit and Bitget, according to a variety of criteria. As a result, OKX turned out to be the most suitable for my needs due to the combination of favorable conditions, reliability and functionality. In this article, I will compare these exchanges in detail by key parameters and explain why, in the end, my main trading turnover is focused on OKX.

In one of the previous posts about “Simple Earn”, a reader asked me what caused my choice of a crypto exchange. I wrote back then that I would try to answer the question in detail. That’s actually the time (and it hasn’t been a year).

- Profitability of Earn products and conditions

- Trading commissions on spot and futures trading

- Trading volumes and liquidity

- Reliability and reputation of the exchange

- Interface and functionality of the platform

- Tools for professional traders

- Verification levels and restrictions

- Customer support

- Conditions for VIP traders

- Why don’t I use WhiteBit and other small exchanges

- Conclusions: why OKX?

Profitability of Earn products and conditions

All leading exchanges provide opportunities for passive earnings in cryptocurrency through the Earn sections (staking, deposit products, landing, etc.). OKX Earn offers a wide range of products, from flexible savings accounts to DeFi-staking and dual-investing. The profitability on popular coins from top exchanges is approximately comparable and is at a reasonable level. For example, on simple deposits in USDT-type stablecoins, the annual rate is several percent (about 5% APR). Binance Earn has similar indicators – for flexible savings on basic coins, usually 1-5% per annum, and on promotional or fixed products you can get a little more (up to 10-15% on individual altcoins). Bybit and Bitget also have their own Earn programs with competitive rates in the same range.

However, the fundamental difference is in the reliability of these incomes. Large exchanges such as OKX or Binance offer moderate and steady APY, relying on real income from margin lending and staking. At the same time, some lesser-known exchanges attract customers with increased interest rates. WhiteBit (I will mention this exchange in the course of the article, as the reader pointed to it), for example, advertises up to 17.39% per annum on a deposit in bitcoin for 365 days and up to ~18% APY on other cryptocurrencies. Against the background of average market values, this looks too good to be true – and below I will explain separately why chasing such % is risky.

As for the conditions, OKX Earn and its analogues do not have hidden fees for depositing/withdrawing funds, everything is transparent. As a rule, flexible products allow you to withdraw funds at any time without losing the accumulated interest, while fixed products require you to wait for the end of the deposit period. OKX, Binance, Bybit and Bitget have low minimum amounts to participate in Earn, and the entry threshold is available even for beginners.

Conclusion: the profitability of Earn products on OKX is competitive with the largest exchanges, while I can be sure of the reliability of paying these percentages, sacrificing dubious over-profits on little-known platforms.

Trading commissions on spot and futures trading

Commissions are a critical parameter for an active trader. Accumulated commissions for a large number of transactions can significantly affect profits, so low trading fees have become one of the decisive factors in my choice.

- OKX: initially attracts a lower commission on the spot compared to competitors. The base rate for spot trading is 0.08% (maker)/0.1% (taker). It is immediately slightly cheaper than Binance. On futures (perpetuals), the standard commission is 0.02% maker/0.05% taker, which is comparable to the largest players. Also, OKXIt encourages holders of its own OKB token – when paying commissions in OKB and increasing trading volume, fees can be further reduced. VIP traders at high levels in OKX receive generally excellent conditions, up to a negative maker commission -0.001% (the exchange pays you for adding liquidity). I have just been provided with VIP conditions on OKX, I will tell you about them separately below.

- Binance: the largest exchange, initially known for low fees. The standard rate on a spot is 0.1%/0.1% (maker/taker), but when using BNB to pay commissions, it is reduced to 0.075%. Binance futures have some of the best conditions: about 0.02% maker/0.04% taker for USD-M futures (for Coin-M contracts taker ~0.05%). Binance also offers many discounts for large volumes and has 9 VIP levels – at maximum VIP spot commissions drop to ~0% maker/0.04% taker or lower (comparable to OKX). In general, Binance and OKX are practically neck and neck in terms of tariffs for active traders.

- Bybit: initially became famous for the fact that did not charge spot commissions during the promotion period, but now the base rate is 0.1%/0.1% on the spot (equal to Binance). With an increase in trading volume, Bybit reduces commissions: for example, if you exceed $10 million in monthly turnover, you can get a rate of 0.0625% maker/0.075% taker. In the derivatives market, Bybit offers very favorable conditions for a trader: 0.02% maker/0.055% taker on perpetual contracts. Bybit also returns part of the commissions to makers at high VIP levels – there is even a negative maker fee for top traders. Thus, Bybit is slightly inferior to OKX/Binance in terms of spot, but it offers close figures on futures, although the taker commission is slightly higher.

- Bitget: standard commissions 0.1%/0.1% on the spot market, which is similar to Binance and Bybit. The advantage is having your own BGB token, which gives you a 20% discount, then the effective rate is reduced to 0.08% (similar to OKX without additional conditions). For large traders, Bitget has a VIP program: commissions can be reduced up to 0.02% maker/0.032% taker, that is, almost at the level of the best VIP Binance/OKX. Bitget futures contracts are traded with a 0.02% maker/0.06% taker commission by default, slightly higher than that of OKX/Binance for taker, but the difference is small.

Withdrawal by commission: of course, OKX stands out for its profitable commissions. Already at the basic spot level, OKX is 20% cheaper than Binance (0.08% vs 0.1% for the maker). All four exchanges offer low fees, especially for derivatives, the difference is minimal (about hundredths of a percent). However, the real advantages are revealed at VIP levels. Due to my VIP status on OKX, my fees are significantly lower than the basic ones.

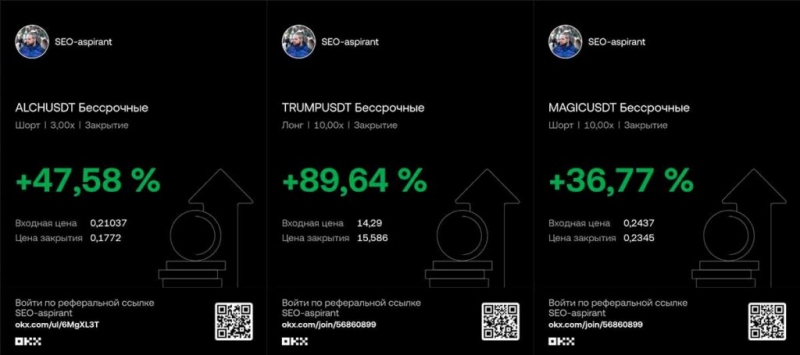

It is also important that OKX willingly competes for large clients – for example, they do VIP status matching: if a trader has a high VIP on Binance, OKX is ready to provide him with a level two steps higher in to your system, when you click on a referral. OKX just allowed me to request VIP+2 from their Binance level for my referrals. As a result, my partners can trade on OKX for almost pennies – the commission for them is several times less than they would pay on Bybit or other exchanges. For example, the standard taker fee on Bybit is ~0.055%, whereas on OKX with VIP privileges it is possible to achieve about 0.01%, that is, trading is ~5 times cheaper.

Trading volumes and liquidity

The liquidity of the market determines with what slippage and at what spread orders, especially large ones, will be executed. The undisputed leader here is Binance – its daily trading volume is often several times higher than that of its closest competitors. So, in late 2024 and early 2025, Binance processed about $20-24 billion per day. For comparison, the numbers of the closest pursuers are an order of magnitude smaller: OKX, Bybit and Bitget have daily turnover in the range of $4-5 billion in the spot market. Nevertheless, these exchanges consistently rank in the top 5 in this indicator. For example, in January 2025, Bybit ranked 2nd in terms of spot volume (~$4.5 billion/day), while OKX and Bitget were almost on a par, generating ~$4.3–4.5 billions per day each. This means that OKX’s liquidity is comparable to Bybit and Bitget, second only to Binance.

In practice, I have no problems executing large orders on OKX. OKX’s orderbook for the main pairs (BTC/USDT, ETH/USDT, etc.) is very deep. The spreads are minimal – the same 0.01%-0.02% on BTC/USDT as on Binance. Even mid-cap altcoins are trading quite briskly. Binance, of course, has a benchmark liquidity: it aggregates the largest number of participants, so Binance is out of competition for the largest volumes. But for 99% of traders, OKX volumes are more than enough. In addition, OKX and Bybit dominate the derivatives segment, offering very high liquidity on futures. Professional traders note that for some popular contracts (for example, BTC-USDT perpetual), the market depth on OKX is not inferior to Binance. At the same time, small exchanges lose heavily in this parameter – they have modest volumes and a limited number of active orders, which is fraught with high slippage when trying to operate with large capital.

The reliability and reputation of the exchange

The reliability of the platform and reputation in the market are key factors influencing the choice of the exchange for long–term use. Here I evaluated the work history, security measures, transparency and attitude to regulations.

- Binance: is the largest exchange, but its reputation is ambiguous from a regulatory point of view. On the one hand, Binance is known for its SAFU fund to protect users and for covering all incidents (such as the hacker theft of ~7,000 BTC in 2019). Customer funds on Binance are technologically protected – the platform has not been seen in serious hacks in recent years. But on the other hand, Binance’s global expansion has led to conflicts with regulators in many countries. In a number of jurisdictions, Binance has been forced to restrict services (for example, in the United States, there is a separate Binance platform.(with reduced functionality, in some European countries the exchange stopped serving customers due to lack of licenses). These events have undermined the trust of a part of the community. Nevertheless, in terms of the number of users and market share, Binance is out of competition – according to polls, about 53% of traders call it their main platform. To summarize, Binance is a giant with a solid history, but the factor of regulatory uncertainty makes it necessary to keep a backup option.

- OKX: was a discovery for me in many ways. The exchange has been operating since 2017 (formerly known as OKEx) and since then has not allowed incidents that would lead to the loss of customer funds. In 2020, there was an episode with the suspension of withdrawals due to the arrest of one of OKX’s key managers, but the problem was resolved, and all user assets remained safe. After the rebranding to OKX, the company focused on strengthening its reputation: monthly Proof-of-Reserves audits are published, confirming that the exchange holds reserves at 100%+ of customer funds. Most recently, in March 2025, OKX released its 29th consecutive reserves report, in which an independent audience (Hacken) confirmed the presence of $24.6 billion in reserve assets on OKX’s balance sheet, which is 5-10% higher than user deposits (BTC: 105%, ETH: 103%, etc.). Such transparency significantly increases trust – I know for sure that my funds are not used somewhere on the side and are always provided with liquidity. In addition, OKX has a high security rating. According to CER.live, the exchange has received maximum cybersecurity ratings (CCSS Level 3, PCI DSS Level 1, etc.), applies cold storage for most funds and holds an insurance fund in case of force majeure. OKX currently serves over 50 million users in 200+ countries and provides them with round-the-clock support and even a hotline. There is an impression in the industry that OKX is moving towards becoming the “new Binance” – as global, but more transparent and regulated.

- Bybit: has gained a good reputation among derivatives traders. Launched in 2018 as a perpetual swap platform, Bybit attracted many users after the BitMEX crisis. Bybit has not had any major security scandals (until recently), and this has given us confidence that the company is serious about protecting funds (they keep 100% in cold wallets, etc.). Bybit is registered in Singapore, and recently moved its headquarters to Dubai in an effort to comply with new regulations. One of the disadvantages is that for some time Bybit allowed trading without KYC, which raised concerns about compliance with AML requirements. But since 2023, Bybit has introduced mandatory verification and has become more “white” from the point of view of regulators. In general, its reputation is positive: the exchange is known for innovations (it regularly launches new products), actively communicates with the community, holds competitions, and bonus promotions. Many traders praise Bybit for the reliability of its infrastructure and the absence of disruptions, even during periods of volatility. Conclusion: Bybit is a reliable platform, although less globally known than Binance. I also used it, but I preferred OKX, partly because of the wider range of products besides futures. And they also tried to scam me on this exchange for $2,000, but I’ll write a separate post about it.

- Bitget: another representative of fast-growing exchanges (founded in 2018). Bitget actively promotes itself through sports (sponsorship of teams, collaborations with influencers) and is known as a platform for copy trading. There is less news about Bitget in terms of security – there don’t seem to have been any serious incidents, but the transparency is lower than that of OKX. The exchange claims millions of users, holds user assets in dedicated wallets, and also published Proof-of-Reserves after the FTX crash. However, its Trust Score on aggregators is slightly lower than that of the grandees (possibly due to less time on the market and volumes). Bitget faced a reputational blow in 2021, when, due to the listing of the K-pop group’s fan tokens, its license in Singapore was temporarily suspended – this case slightly undermined its credibility. Now Bitget is trying to strengthen itself: it has moved its headquarters to Hong Kong, implemented KYC, and is forming a $300 million user protection fund. In my eyes, Bitget is a solid second league: you can use it, but you don’t have the scale and openness of OKX/Binance yet.

General summary on reliability: I prefer exchanges that have proven themselves with time and transparency. OKX and Binance are the undisputed industry leaders who are trusted with huge amounts of capital. OKX attracted me because it combines a high level of security (audits of reserves, technical protection) readily comply with regulatory requirements. This reduces the risk of sudden withdrawal problems or account blockages. Bybit and Bitget are also relatively reliable, but they are slightly less versatile and their reputation is still being formed. WhiteBit and other small exchanges cause me much more doubts – more on that later.

Interface and functionality of the platform

The convenience and functionality of the trading platform directly affect the trader’s work efficiency. Here, each of the exchanges under consideration has its own strengths, but in general, all four offer modern, thoughtful interfaces.

- OKX: is famous for its user-friendly interface and thoughtful UX, even with an abundance of features. After the rebranding, the design of the platform became more minimalistic and clearer than that of the old OKEx. I liked that the OKX application has “Lite” mode for quick exchange, and “Pro” mode with a fully functional terminal – you can switch depending on the task. OKX’s web interface is very flexible: you can customize the trading window, change the layout of the widgets, and expand the chart to the full screen via TradingView. At the same time, all advanced types of orders are available (limit, market, stop loss, take profit, OCO, etc.). OKX’s special advantage is a unified account. This means that I have a single balance sheet for spot, futures, options and margin trading, and I can freely use all assets as collateral. Such a system greatly simplifies the life of advanced traders, allowing them to manage their money more efficiently. Overall, the functionality of OKX seems to me comprehensive Questioner: there is spot trading, margin trading, derivatives (futures up to 100x and options), copy trading, embedded bots, and even a Web3 wallet. In fact, OKX has become a universal crypto hub for me, where everything necessary is gathered under one roof.

- Binance: provides, perhaps, the richest functionality among all exchanges. In addition to standard trading, dozens of additional services are integrated on Binance – from a P2P platform, cards and loans to an NFT market and its own BSC network. Binance’s interface is quite loaded, and it can be difficult for a beginner to figure everything out right away. There is a switch between the “Beginner” and “Advanced” modes in the trading terminal, plus simple tabs for quick exchange (Convert) are displayed separately. Advantages of Binance:Excellent charts (TradingView), lots of indicators, deep glasses, detailed market information (there are analytics sections, portfolio, etc.).Minuses:Due to the abundance of features, sometimes the interface slows down, especially the web version under load. But in general, Binance sets the bar for the number of opportunities. For professionals, comprehensive tools are available there, including API/WebSocket connectivity, customizing the UI in a Desktop application, and using subaccounts to separate the strategy. I appreciate Binance for its functionality, but I must admit that OKX is not inferior to in key things for me. For example, Binance did not have a copy trading service at all until recently, while OKX has already implemented this feature. Binance also does not support a single balance for different types of trading – you need to transfer funds between a spot wallet, futures, and margin, which is inconvenient compared to the flexibility of OKX.

- Bitget: strives to keep up by offering a similar traditional interface. The Bitget trading terminal looks very similar to Binance – apparently, they tried to make it familiar to users. Bitget’s special feature is its focus on Copy Trading: right on the main screen there is a tab with successful traders, their profitability statistics and a “subscribe” button. This attracts a lot of newbies who want to follow the professionals. The rest of the functionality of Bitget covers the basic needs: spot, futures, P2P, Earn, its Launchpad (Bitget Launchpad). Charts are integrated from TradingView, technical analysis is available. The Bitget app is well optimized. So far, I would say Bitget doesn’t offer anything radically new in terms of interface, but there are no obvious weaknesses either. It’s just a well-made exchange based on the patterns of the leaders.

Bybit: was originally built as a platform “from traders to traders”, so Bybit’s trading interface is very thoughtful. It resembles Binance/OKX, but without the unnecessary distractions. Bybit has been focusing on derivatives for a long time, and it feels like everything you need for analytics and fast futures trading is here. TradingView-chart, customization of work windows, different design themes – everything is present. In recent years, Bybit has added a spot and many altcoins, but the interface has remained fairly light and fast. A big advantage of Bybit is the demo platform (testnet) – you can train without risk. Bybit has also introduced copy trading, allowing experienced traders and trading bots to subscribe to trades (the network offers templates for grid bots and DCA). The Bybit mobile app is convenient, not overloaded with unnecessary things – perhaps even more intuitive than Binance. As a result, I rate the Bybit interface highly. The only thing that is almost missing is such a wide range of products as on OKX/Binance (there is no own blockchain, there is less choice of Earn products, there is no Launchpad). But for purely trading tasks, Bybit does an excellent job.

Bottom line: all the exchanges under consideration provide rich functionality necessary for both novice and experienced traders. A couple of unique OKX features became crucial for me: a single trading account and early integration of Web3 elements. OKX has integrated a non-custodial wallet and access to dApps into the platform, which opens the door to the world of DeFi directly from the exchange’s app. Thus, in addition to regular trading, I get a single space on OKX for all my crypto activities – from trading to earning money and interacting with the blockchain. Binance is also moving in this direction, but it is implemented more separately there (a separate Trust Wallet application, a separate Binance DeFi). Bybit and Bitget are currently focused mainly on trading and copy trading. Therefore, the combined interface + functionality of OKX has come out ahead for me – I feel that I am working on a modern, technological platform that does not stand still.

Tools for professional traders

As a trader who actively trades, I appreciate the availability of advanced tools and automation capabilities. In this regard, all four exchanges are trying to satisfy the needs of the pros.:

- Trading terminals and APIs. Binance, OKX, Bybit, Bitget all provide APIs for programmatic trading and the connection of bots. In my personal experience, the OKX API is quite reliable and fast, and there are enough restrictions on the number of requests for algorithmic trading. The Binance API is the most popular on the market, and many third-party bots and software are tailored to it. The Bybit API is also well documented – especially the derivatives endpoints, many former BitMEX users have moved to Bybit and continued trading through the API without problems. The Bitget API is slightly less common, but it is also quite functional. I would like to note separately that Binance and OKX offer desktop applications – this is convenient for those who trade from a PC and want minimal latency and no dependence on the browser. I chose the OKX Web + API terminal for myself: my algorithmic system sends some orders via the OKX API, and I use a web terminal and a mobile application for monitoring and manual interventions.

- Advanced orders. All exchanges support a standard set: limit, market, stop limit, stop market, take profit, stop loss. Binance and OKX go further and offer OCO orders (One–Cancels-Other) on the spot, which is very convenient for setting take profits and stops at once. Plus they have a Trigger Order with flexible logic. Bybit on derivatives also allowed you to set a stop and a limit simultaneously through the TP/SL function when opening a position. In general, there is parity in terms of orders – none of the top exchanges have restrictions that would interfere with trading (unlike small exchanges, where sometimes there is no basic stop order).

- Margin trading and leverage. All the platforms under consideration offer margin leverage. Binance and OKX for spot provide margin lending (margin accounts) with leverage up to 5-10x. Bybit does not provide direct margin trading on spot, but offers perpetuals with leverage up to 100x, which is equivalent. OKX and Binance also support futures with high leverage (up to 100x on OKX, up to 125x on Binance). Bitget provides leverage of up to 100x on futures. It is important for professionals that all exchanges have cross and isolated margins, and the ability to manage risks flexibly. I liked that OKX Unified Account allows you to use a single cross-margin pool of liquidity: that is, all assets cover each other. This gives you more freedom when trading different instruments at the same time.

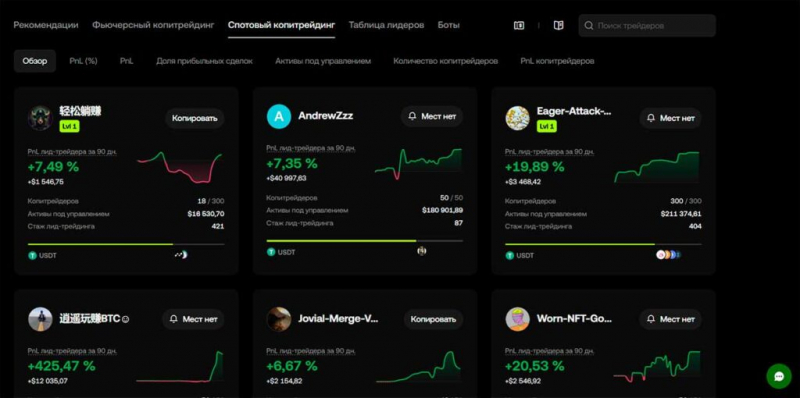

- Copy trading and social functions. Bitget stands out here (positioned as the No. 1 platform for copying transactions) and OKX/Bybit, which have also implemented such functionality. I personally don’t use copy trading (I prefer my own strategies), but for the sake of review, I note that on OKX you can subscribe to the strategies of successful traders – the platform itself will repeat their trades on your account. Similarly, there is Copy Trading on Bybit (there is a “Copy Trade” section in the application). Binance has only recently announced the launch of a similar feature and is still lagging behind in this. Social trading features are a trend in 2023-2024, and OKX and Bybit promptly picked it up, which indicates customer orientation.

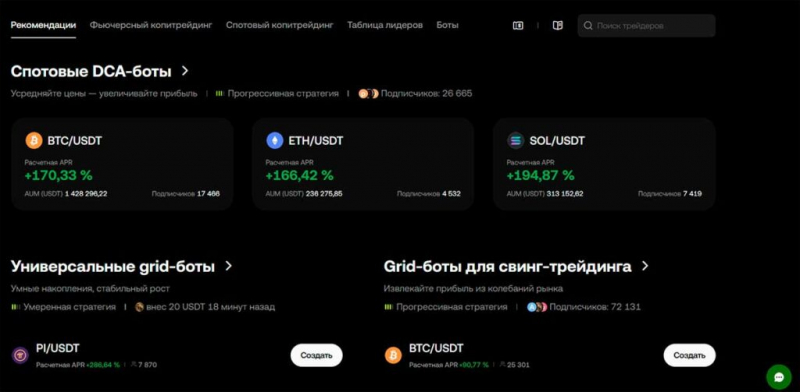

- Trading bots and algorithms. OKX has several built-in auto–bots, such as grid trading and DCA (averaging). Binance also has grid bots and algorithmic orders (for example, time–based placement – TWAP). Bitget offers a user-friendly interface for creating a grid bot, and Bybit has launched a bot for spot trading. In addition, OKX and Binance support external algorithmic platforms: it is possible to connect via API to TradingView, Quadency, 3commas, etc. For a professional, this is important – the ecosystem of tools around top exchanges is better developed than that of small ones.

Output: as a trader, OKX provides me with a full arsenal of tools: a reliable API, any type of orders, a wide range of derivatives (in addition to futures, OKX is one of the few offering full-fledged options on BTC, ETH, SOL), as well as pleasant bonuses like built-in bots and copy trading to diversify strategies.

Binance, Bybit and Bitget are also rich in functionality, but OKX is in no way inferior to them, and in some ways even surpasses (for example, by having options that are not available on Bitget/Bybit). Therefore, from the point of view of the toolkit, I do not feel limited when trading on OKX – on the contrary, I have room to implement any strategies.

Verification levels and restrictions

KYC/AML regulatory requirements have become tougher in recent years, and all major exchanges have had to introduce user verification. Previously, many people chose a platform based on the principle of “where they do not require a passport,” but now this approach is losing relevance – Binance, OKX, Bybit, Bitget all request documents for full-fledged work.

- Binance: has made KYC mandatory for all since 2021. Now, without basic verification (passport/ID + selfie), you won’t even be able to trade. The basic level removes the restrictions on input/output up to eq. 50 thousand USDT per day. To increase the limits (up to $200k or more) and access to fiat transactions, extended verification is needed (address, proof of income, etc.). Binance was one of the first to introduce such measures after the claims of regulators, and now it is the most “regulated” player among global exchanges.

- OKX: also requires KYC. If you just register by email, you may be allowed to view the interface, but you need to confirm your identity for trading and withdrawal. OKX, as far as I remember, has 2 verification levels: basic (sufficient for most operations, withdrawal limits of about 200 BTC per day) and advanced (for institutions, the limits are higher). I completed KYC on OKX without any problems in a couple of hours – the process is standard. In general, OKX complies with global AML standards, for example, it does not serve clients from sanctioned countries, from the United States. But there are no problems for the CIS and most countries: my account was originally registered as a resident of Armenia, and verification was quick.

- Bybit: has long been known as the last major exchange without mandatory KYC. However, since the fall of 2022 and especially in 2023, Bybit has introduced gradual restrictions for the unverified. Now, in fact, it is impossible to withdraw a large amount without a passport – for amounts over eq. 20k USDT per day needs verification. And in general, new features (Launchpad, Earn, etc.) require KYC to be passed. So Bybit is now in the same boat with the rest – new users should be verified immediately. KYC levels are similar to Binance: basic – up to 1 million USDT/day, advanced – up to 2+ million. This covers the needs of 99.9% of people.

- Bitget: has also gradually implemented mandatory verification. At the beginning of 2022, it was possible to trade without documents, but by 2023 Bitget announced KYC must-have. Verification takes a day, and a passport is required. The limits after that are quite generous – you can withdraw up to 100 BTC per day, which is enough for all retail traders.

Thus, differences between KYC exchanges are minimal: all comply with the requirements and request personal data. This doesn’t bother me, as I already work with large amounts of money and prefer legal and transparent activities. Rather, choosing OKX in terms of compliance is a plus: the exchange operates legally and will not force me to look for a new home in a hurry due to regulatory pressure.

The only possible difference is local jurisdiction and restrictions. For example, Binance is unavailable in some regions, Bybit has withdrawn from the Japanese market, etc. OKX is closed to users from the United States. But in the CIS countries, Europe, Asia, OKX is open and legal everywhere. My account has been verified and I am calm about its status.

Customer support

High-quality customer support is important, especially when dealing with large amounts of money – you want to quickly resolve any issues that arise. I will share my experience and information:

- OKX: the support service was pleasantly surprised. Firstly, there is a 24/7 live chat on the site, the operators respond in Russian and English fairly quickly. Secondly, a personal manager is provided for VIP clients. I have a contact from OKX who I can contact directly on Telegram for any questions, from technical problems to product advice. This level of attention is very valuable. Fortunately, there were no serious problems: I only clarified the status of depositing funds a couple of times – they responded promptly, in a couple of minutes. OKX also maintains official Russian-language channels on Telegram, where community managers help with general issues. Overall, I give OKX a solid five for its support.

- Binance:Binance also has round-the-clock chat support, but due to the huge number of users, they often complain about the long wait for a response. There were cases when the ticket was resolved for several days. On the other hand, Binance has the most extensive knowledge base: forums, FAQ, training materials – you can often find the answer yourself without waiting for the operator. Binance also allocates personal managers and a priority line for VIP, but it is not easy to reach such levels (hundreds of millions of trading volumes are needed). At Binance, I had experience communicating with support for unblocking withdrawals – it was solved, but it took more than a day. In comparison, similar issues were resolved faster on OKX.

- Bybit: actively advertises its 24/7 customer service. Indeed, judging by the reviews, Bybit tries very hard to keep a straight face – they respond quickly in the chat, the staff are polite. Perhaps a slightly lower load than Binance has an effect. Bybit also has strong community support: their moderators are on Reddit, Telegram, and answer questions. I asked a couple of times about entering a fiat, and they quickly gave me clear instructions. In general, Bybit is praised in the community for its support, and I agree that it is on the level.

- Bitget: is not the most well–known brand yet, so there are fewer calls, which plays into its hands. They answered me pretty quickly on Bitget when I had a verification question. There is a Russian-language chat, e-mail support. They may not have as well-honed processes as Binance, but they are trying. Plus, Bitget and Bybit, like younger companies, have a desire to gain loyalty, so they are more flexible in communication and can meet disputes halfway.

Bottom line: in my experience, I put OKX and Bybit first in terms of customer support – fast and friendly. Binance is slightly less personalized due to the scale, but compensates with self-service (knowledge base). Bitget is somewhere in the middle. Having a dedicated manager at OKX is a huge plus for me, because I know that if an emergency happens, I won’t have to wait in line, and the issue will be resolved through the red phone. This is another building block in the foundation of trust in OKX.

Conditions for VIP traders

Finally, I’ll move on to what particularly influenced my choice – the program for VIP traders on OKX. When you trade large volumes, exchanges are ready to compete for you by offering the best conditions.: reduced fees, personal service, and other benefits. I compared the VIP programs of Binance, OKX, Bybit, Bitget and came to the conclusion that OKX is more profitable for me.

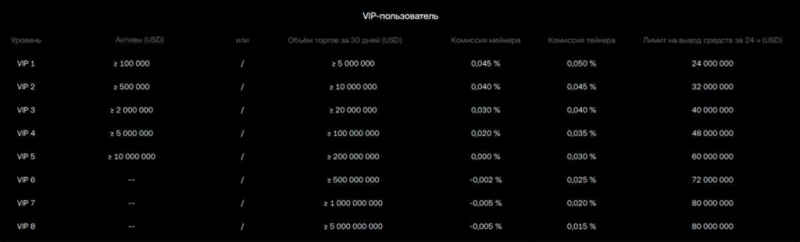

VIP structure: is usually assigned a level of 1 or higher based on the 30-day trading volume and/or deposit size. Binance has 9 VIP levels, OKX has 8 levels (VIP1–VIP8, plus a special Market Maker status for the elite), Bybit has 5 levels (VIP1–VIP5), Bitget – also about 5 levels. Increasing the level requires serious turnovers: for example, on Binance, for VIP1, you need to trade $1 million per month and hold 25 BNB, for maximum VIP9, the volume is $2 billion. The criteria for OKX are similar, but they also take into account the OKB token hold to simplify – you can compensate for the missing turnover by having OKB. As a result, it is slightly easier to achieve average VIP on OKX than on Binance.

Reduced fees: the main thing that VIP offers is commission discounts. I have already shown the figures: on Bybit VIP3 (turnover ~$10M), the commission drops to 0.0625%/0.075%. On Binance VIP3 (turnover 1,500 BTC), spot commissions are ~0.08%/0.1%, and with VIP 8-9 they are practically zero. OKX is very generous in this regard: at the upper levels, up to a maker rebate of -0.001% and a very low taker (~0.03%). In fact, once you reach the top status on OKX, you trade almost for free. I’m still far from the top, but even my current level gives significantly better commissions than the base ones. In addition, OKX offered me special conditions during the transition: they took into account my status on Binance and immediately assigned a comparable VIP on OKX without the requirement to instantly gain turnover. This flexible approach is endearing – the exchange values its customers.

Additional bonuses: VIP users often receive a number of privileges: increased API limits, higher withdrawal limits, access to closed beta tests, support manager, invitations to events. Binance has offline meetings for top VIPs and gives them gifts for the holidays. OKX is also doing this – I have repeatedly received offers from them to participate in private AMAs and webinars with the team. Nothing supernatural, but the attention is pleasant. Bybit organizes competitions with prizes for VIP, personally notifies about new listings. Bitget lures VIP with cashbacks and sometimes deposit bonuses.

However, the most valuable thing for me was that OKX helps my partners get VIP status as well. As I mentioned, OKX is ready to upgrade referrals: if a trader transfers from VIP to Binance, OKX gives him 2 levels higher than VIP on its platform. This is phenomenally profitable – my friends who have taken advantage of this opportunity are now saving good amounts on commissions. Trading on OKX with VIP discounts is about 5 times cheaper than on Bybit without the status – the difference is enormous by the standards of industrial trading. Thus, OKX builds vin-vin cooperation: I bring large clients – the exchange gives them super conditions. Binance did not offer such VIP matching (it rather dictates the rules itself), Bybit sometimes arranges VIP promotions, but +2 levels is something special from OKX.

Conclusion: OKX provides perhaps the most attractive VIP conditions for an active and large trader . Not only in terms of commissions, but also in an individual approach. I felt like a valued customer, a part of the OKX ecosystem, and this, of course, inclines to loyalty. Binance, for all its advantages, is more impersonal – you are one of millions, even on VIP. At OKX, even at the VIP 2-3 level, a live customer service team is already in contact. As a result, in terms of savings on fees and comfortable service, my choice fell on OKX.

Why don’t I use WhiteBit and other small exchanges

There are many lesser–known exchanges in the crypto space that sometimes offer very attractive conditions, especially in terms of Earn products (high interest rates) or bonuses. WhiteBit often advertises increased interest rates, KuCoin attracts a wide range of coins and also high APY, there are quite exotic platforms with huge deposit bonuses. However, I deliberately avoid small exchanges, even if they promise potentially large profits. Here are my justifications:

- A dubious reputation. Ymany small exchanges do not have the same reputation as the leaders. For example, WhiteBit is actively promoted in the CIS, but if you study the reviews, you can find many negative reviews. On one of the rating sites, WhiteBit received a rating of only 1.5 out of 5 and only ~13% positive recommendations. Users complain about problems with support, lengthy checks when withdrawing funds, and someone accuses the exchange of being completely unscrupulous. I’m not saying that WhiteBit is a scam, but the sediment remains. When my capital is at stake, I prefer not to take risks with a company that has so many alarms going off.

- Lack of deep liquidity. Earlier in the volume section, I showed that even the top 5 exchanges have $4-5 billion in daily turnover. The numbers for secondary platforms are an order of magnitude smaller. WhiteBit declares about $1 billion in volume per day, but it is important to understand the structure of this volume. Such exchanges often support many pairs, but the real liquidity is concentrated in the BTC/USDT pair (on WhiteBit ~37% of the volume is BTC/USDT). In other markets, there may be scanty turnover and single transactions. That is, you can buy and sell bitcoin relatively normally, but try to sell altcoins – you will face huge spreads and the inability to quickly switch to fiat. I’ve personally seen orderbooks on some local exchanges.: there’s an empty glass, $5-10 k immediately moves the price by interest. This is unacceptable to me. The depth of the market is a guarantee that you will close a position close to the market price at any time. There is no such guarantee on small exchanges.

- Capital risks. The history of cryptocurrencies knows of many cases when small exchanges went bust or became victims of hackers, and users lost money. Even large exchanges are not insured (let’s recall MtGox, FTX – although FTX was top-3, it also collapsed). What can we say about small platforms whose resources are limited. Let’s take the same WhiteBit: she claims to be safe and even entered the top 5 in cybersecurity (according to their statements). But she has no public evidence of reserves, it is unknown how financially stable she is. If there is a massive outflow of funds tomorrow, will there be enough reserves to return the money to everyone? Without transparency, I don’t trust it. Plus, high interest rates on deposits (up to 18% APY) hint that the exchange is either risking these assets heavily or subsidizing income from its own pocket in order to attract customers. In the first case, it is dangerous (you can lose everything if the borrowers do not return the funds), in the second – the model will not last long, the business will go into losses. In the end, who will pay? Most likely, users will use commissions or other mechanisms, or the program will collapse as quickly as it started.

- Regulations and legal protection. Large exchanges, although not perfectly regulated, still try to obtain licenses (Binance, OKX, Bitget are registered at least in loyal jurisdictions such as Seychelles, BVI, or receive local licenses in certain markets). Small ones often operate semi-legally. For example, WhiteBit is registered offshore (it is listed in Lithuania, but the main market is the CIS/Ukraine). In case of disputes or problems, it is difficult to legally recover something from such a company. There are no serious audits, there is no insurance of funds. I am aware that entrusting my money to the exchange is a risk, so I choose those with scale, reputation, and at least some regulatory responsibility. A conditional WhiteBit does not give me confidence that something unexpected will not happen tomorrow.

- Marketing tricks. Very high staking rates or excessive registration bonuses are often a trap. Small exchanges want to quickly gain an audience, for example, they give “20% per annum on USDT” or “$100 deposit bonus”. But in the fine print conditions, there is a huge trade turnover for working off the bonus, or a limit on the amount for 20% APY ($500 maximum). Many people succumb to advertising, carry money, and then become disillusioned. I try to look deeper than the ads. If Binance or OKX give 5-10% on the stable, I understand that this is real. If some NoName gives 30%, it’s clear that there was a catch. As a result, I prefer stability over a crane in the sky. Let them pay me 5% on OKX Earn instead of 15%, but I am confident that I will actually receive this 5% and will be able to withdraw my deposit at any time.

Why not WhiteBit? I have nothing against this exchange personally, it’s just that the reader asked specifically about it, and it serves as a good example. Against this background, the advantages of OKX and other top exchanges are visible: a more reliable reputation, proven liquidity, transparency and the absence of suspicious promises. Yes, WhiteBit is actively promoting itself, even claims to be secure and has its own WBT token. But I remember how many exchanges before her built a similar PR – and not all have stood the test of time.

Choosing an exchange is like choosing a bank for money: I prefer a large international bank (even if the deposit interest is more modest there) than a beautiful small bank with the promise of golden mountains.

Conclusions: why OKX?

After analyzing all of the above aspects – from the profitability of products to customer support – I came to the firm conviction that OKX is currently the optimal platform for my crypto trading. This exchange offers a balanced set of advantages:

- Low commissions on all types of trading (especially considering VIP status, commissions are minimal).

- High liquidity in key markets, comparable to industry leaders.

- Reliability and transparency, supported by audits of reserves and the absence of incidents of loss of funds.

- User-friendly interface and powerful functionality, including even the latest trends (copy trading, DeFi integration).

- Excellent conditions for VIP and active traders, including individual support and special offers for partners.

- Round-the-clock support, which really helps when you need it.

A comparison with other top exchanges has shown that Binance, Bybit and Bitget also have their advantages, and each may be the best choice for certain tasks. However, was the best fit for my trading style. Binance suffers from gigantomania and related risks (regulators, overloaded support). Bybit is great for derivatives, but inferior in ecosystem and product diversity. Bitget is good for copying deals, but in other respects it repeats its older brothers in many ways, without standing out particularly.

I also explained why I don’t pursue excessive profitability on platforms like WhiteBit. Experience and analysis convince us that the reliability and safety of funds is more important than potential benefits. The cryptocurrency market is full of opportunities to make money, and it is not necessary to take risks on dubious exchanges for the sake of a couple of extra percentages.

In conclusion, I would like to note that choosing an exchange is a personal matter. My goal is not to advertise OKX blindly, but to share my informed choice. At the moment, OKX gives me the peace of mind and benefits I was looking for: my money is safe, trading costs are minimal, and the service is excellent. Therefore, answering the question “Why did I choose OKX for trading cryptocurrencies”, I can confidently say: because according to the combination of factors, this exchange turned out to be the best solution for me, overtaking competitors and instilling confidence in the future of my trading.